Pega Collections

Increase cash collected and improve the customer experience

"We use Pega to execute 13 million cases a year, so volume is huge in Pega."

analytics-based payment offers

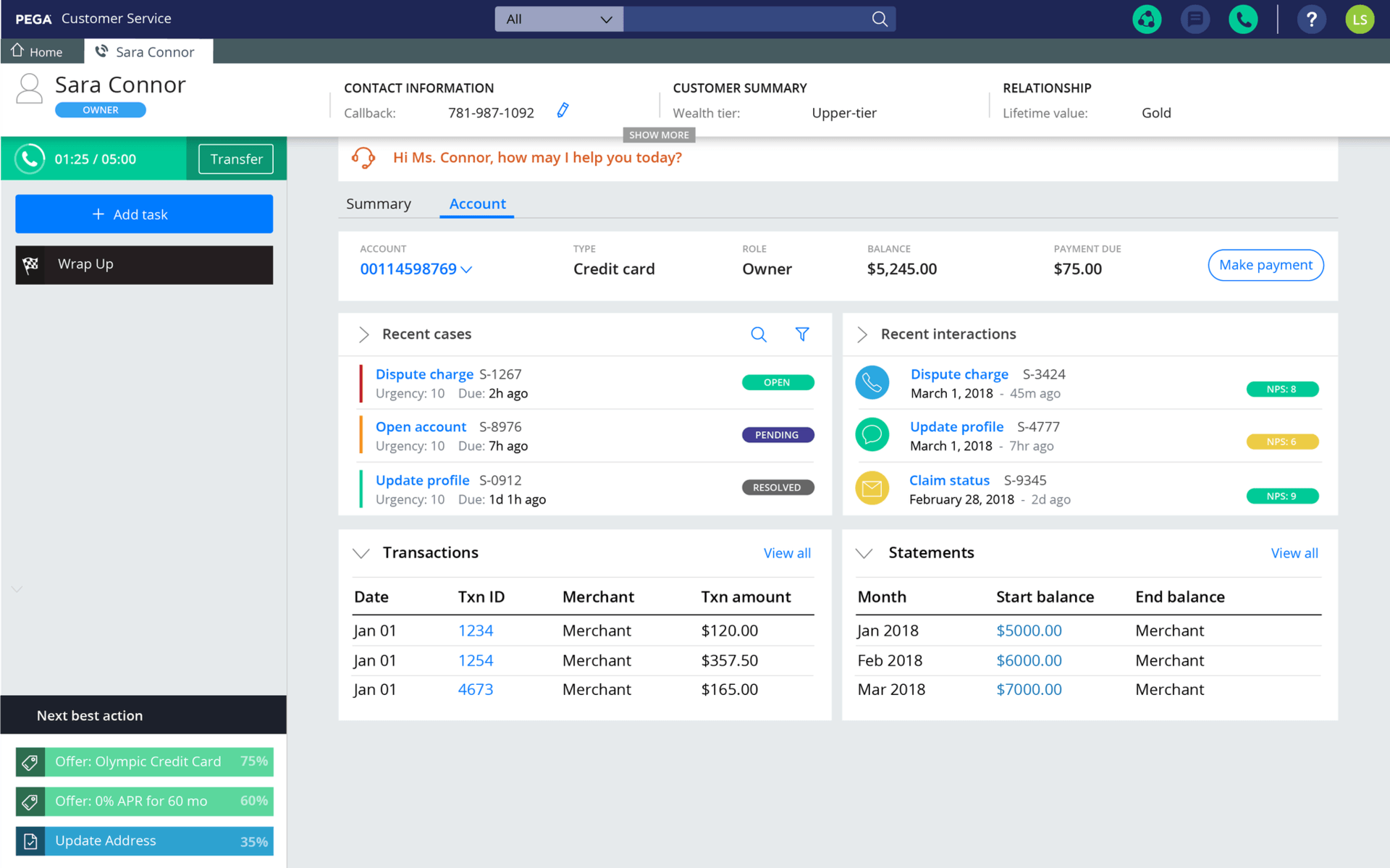

Pega features responsive, multi-channel intake that automatically adapts to products, regions, and risk profiles. The result: Faster intake and higher quality data, for fewer follow-ups. Manage all AEs and Complaints, for any product or source, with clinical, social, and contact center support.

complex process guidance

Ensure an accurate, compliant, and personalized customer experience every time. Pega uses the context of each interaction to intelligently guide conversations through complex collections processes, providing relevant dialogue, knowledge content, data, and actions for customer representatives.

intuitive strategy control

Pega provides an intuitive, graphical way to model and create collections strategies and then fine-tune them in production with sophisticated test and control functionality. As a result, your employees can continuously adapt and improve collection strategies as market conditions change.

omni-channel experience

Provide your customers with a seamless experience across all channels and devices without loss of context. Omni-channel management lets your customers connect with you whenever they want and wherever they go, across online interfaces, mobile devices, and social networks.

Pega’s dynamic case management automatically connects the people, systems, processes, and data required to resolve collections issues, increasing efficiency while ensuring you deliver on the service you promise your clients.

Pega Co-Browse

Customers can securely share the same web page—invaluable for more complex default management cases.

Pega DocuSign Integration

Capture digital signatures with integrated DocuSign digital signature capabilities.

Unified messaging

Provide an efficient, consistent customer experience for website visitors.

Pega Sales Knowledge base

Embed the content you need with Pega Sales Knowledge Base.