Pega KYC Solutions

"Pega scored highly for its KYC risk scores, its capabilities for enriching customers’ profiles, its support for additional due diligence, and its Customer Lifecycle Management (CLM) capabilities."

Get to Know Pega CLM-KYC Solutions

Manage compliance globally with

Pega CLM-KYC solutions

Pega CLM-KYC solutions

Pega CLM-KYC manages compliances with country and product specific rules (such as AML/CTF, FATCA, CRS, FINRA, MiFID II, EMIR, Dodd-Frank, IIROC, and EU AMLD) to efficiently onboard and maintain multi-product and multi-jurisdictional clients in retail, wealth management, commercial, and institutional banking.

Stay compliant with

regulatory best practices

regulatory best practices

Pega's regulatory rules are developed by a global team of lawyers, regulatory experts, and policy makers with deep experience across all main regulators including the SEC, OCC, FinCEN, CFTC, FINRA, HKMA, MAS, FCA, and ESMA, and with the invaluable ongoing input from our client community.

Respond faster with

automated remediation

automated remediation

Rapidly respond to audit and regulatory findings with “look-back” capabilities, through automated bulk case creation, routing and escalation, as well as auditability of rule changes. Quickly update rules through configuration and rapidly address any findings with a zero code rule management portal.

Scale rapidly with

reduced implementation time

reduced implementation time

Pega's proven implementation methodology, risk-based approach and pre-built functionality ensures rapid delivery and use. Leverage existing connectors to third-party systems (e.g. World-Check, Equifax, Markit, etc.) and 88,000+ out-of-the-box regulatory rules and pre-configured data rules.

Accelerate time to revenue with

multi-jurisdictional, multi-product onboarding

multi-jurisdictional, multi-product onboarding

A rules-based approach allows you to onboard clients across jurisdictions, business lines, or products. Apply local regulatory requirements where necessary, collecting only additional information as needed.

KYC Related Resources

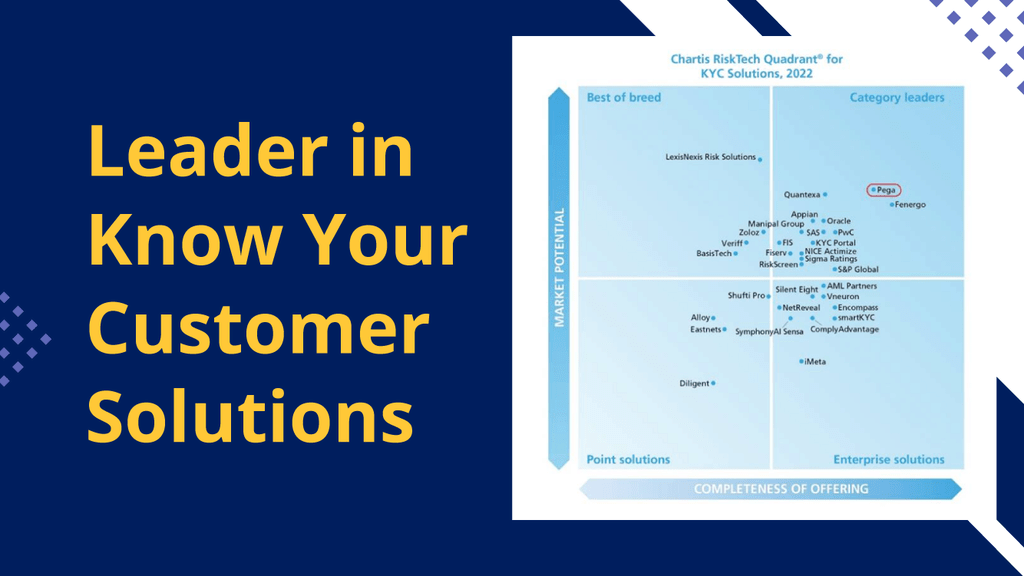

Analyst Report